This post will show you how to create a budget that is effective and easy to follow no matter what your income is. I will show you how I created a budget when I was a beginner and how my process has changed to create an easy to execute financial plan.

I know, I know, there are hundreds (correction, thousands) of posts on the web that teach how to create a budget. Yet, here I am adding to those posts.

Do I feel redundant sharing how I follow a budget? Yes.

Am I going to share my budget practices with you, dear audience, anyway? You betcha.

Why?

Two reasons:

1) In my previous career I was in the financial planning industry, and for seven years, I helped my clients everyday to learn to budget and build wealth. I learned that many people enter adulthood without evening knowing how to budget, or save, or build credit, or how to invest. One of my gifts from that career was getting to teach these basics to others, and I still want to share these.

2) I have a unique experience as a divorced 32-year-old on just how important a budget can be especially when your budget drastically drops due to a life change. So basically, getting divorced gave me a unique perspective on why everyone should follow a budget.

So here we go. I’m going to show you how I’ve created a budget for myself, how I’ve implemented the budget into my life, and some tips I’ve learned along the way.

Related: How to Save Money When there's No Money to Save

Related: How to Spend Sunday Planning for a Stress-Free Week

Full disclosure: I’m going to share my personal finances with you. Why? I want to show that I am human, and while I am not financially where I want to be, I am much further along than where I was even a year ago. I’m proud of myself. I’m excited to see where I continue to grow.

Step One: Show me the Money

One crucial part of building a budget is knowing just how much money is coming in. This step seems pretty self-explanatory, but you would not believe how many of my clients had no idea how much each of their paychecks were. I mean, yes, if you work hourly, your paycheck is more likely to vary more than someone who is salaried. I would tell my hourly-paid clients to start tracking their hours so they had an idea of how much they would have in their next paycheck.

Side note: when you look at your paystub, look at how much you pay for all of your voluntary withdrawals. Are you paying for dental insurance? What about vision insurance? If you are paying for these coverages, MAKE SURE YOU USE THEM. I don’t know how many people I worked with that paid for vision or dental coverage and said they never used it. Cripes.

Knowing how much money you make per week, two weeks, or month, is key to starting your budget. You cannot budget what you do not have.

Step Two: Look at Your Bank Statements

I think this is the most important step of budgeting when you are first beginning. You’ve gotten to this point—deciding it’s time to create a budget—because you felt you didn’t have a handle on your finances. Great! I’m glad you’re here!

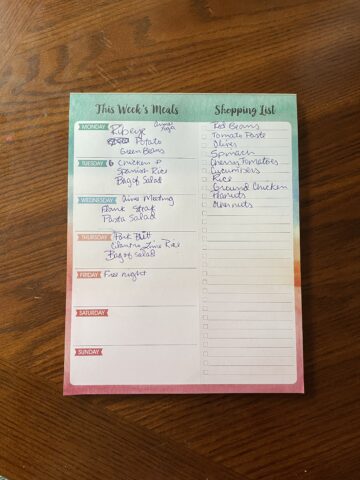

When I was in the financial planning industry, I made all my clients print their actual bank statements and sort their spending into categories: housing, insurance, groceries, utilities, daycare, etc. Now, when was the last time I had actually looked at where my money was going? Let’s just say it had been a minute.

So, I sat myself down with my bank statements, and had my eyes opened. You guys, I spent $203 at Target in the past month. On what!? I HAVE NO FREAKING IDEA. Ugh, wake up call.

What I realized is this step--actually checking your bank statements and seeing where your money is going--is so so crucial to getting a handle on your budget. If I wouldn’t have done this, I wouldn’t have seen how much I spend at Target (woof), and get a reality check.

Step Three: Actually Write Your Budget Out

After you’ve figured out what you have to spend (income coming in), and where you’re spending your money (or overspending), it’s time to actually create a budget.

When I started my budget, I had an idea in my head of what all my monthly expenses were, however, I knew just letting those numbers float around in my head is not enough to help me follow my budget. I knew my rent and my life and disability payment came out at the beginning of the month, and my car payment came out of my account around the 15th, and my cell phone needed to be paid somewhere in there, but had no clue the exact date. I knew I needed to record them all to not only stay on track, but to also alleviate the risk of paying more money in late payments.

When I was newly divorced, re-doing my budget I just wrote my expenses in a notebook, which is a great simple way to begin which I will expand on in a second. My budget now has evolved into something a little more than just writing everything out, however, you have to start somewhere.

I now do two different things: I keep an excel document that spells out my income vs. expenses and how much I’ve budgeted for, and I track all my auto-withdrawal dates on my phone’s calendar so I am notified when money will be coming out. These steps have been monumental to keeping on track.

Like I said, I started with a notebook. I started with writing down all the non-negotiable expenses (the pay-every-month, no-excuses-same-amount payments):

· Rent: $750

· Student Loans: $200

· Car payment: $367

· Life & Disability Insurance: $71

· Car Insurance: $67

· Renter’s Insurance: $16

· Cell Phone: $123

· Northwestern Energy**: $30

· Medical Bills*: $50

· Credit Card*: $100

· Savings*: $100

Total: $1,874

*These three line items: medical bills, credit card and savings are variable, but also non-negotiable. I have both medical debt and credit card debt that I pay on every single month.

While I would love to pretend I didn’t have that debt, I do. I am not ashamed by it, nor do I fear it. I know making these payments every month is getting me closer to where I want to be financially. Which is why I also make sure I save what I can as well.

Would I like to save more? ABSOLUTELY. But, I’m going to save what I can now, as opposed to not saving anything.

**I set up my electricity payment to be the same every month through my energy company. You can reach out to your energy provider and have them set you up on the same program.

Okay, so I had these “hard numbers,” in my budget, but I knew something was missing. Remember those Target dollars from actually looking at my bank statement? Yep, I had to add those in (and when I started this budget post-divorce, my “Target dollars,” went to other things because I lived over 100 miles from the nearest Target, but you get the point, right?)

After I have spelled out my non-negotiable expenses, I add my variable budget items, or items that don’t have a set payment. For example, I don’t know how much I will spend on gas per month or groceries. I have been able to find an average for these expenses by looking at my online banking over the last few months and come up with an average. I also set a “Miscellaneous,” category, because I know myself, and I know things will come up that I need to budget..

· Fuel: $50

· Groceries: $260

· Subscriptions: $26

· Travel Savings: $25

· Eating Out: $55

· Miscellaneous: $50

Overall budget: $2,315

Again, these are rough numbers, but they’ve given me an idea of where I need to be going forward. Obviously, “Miscellaneous” spending is not currently at $50, but I need to make a conscious effort to change that behavior. However, having this guideline in place is going to help bring an awareness to where my money is going. This is a great way to get started.

Step Four: Follow your budget, adjust where necessary

The biggest misconception about budgeting is “set it once and forget it.” I’m sorry, that’s not how budgeting works. I am constantly looking at and updating my numbers to fit my lifestyle and income. I look at my budget sheets, my bank account, my paystubs, etc., every single week. I’m able to see what payments are coming out soon, any events, trips, birthdays or other things I need to plan for financially as well.

We all have to start somewhere, and I hope this has provided you a good guideline of where to get started.

- Know your take-home income

- Look at your bank account and analyze where you are spending your money

- Set a budget with non-negotiables and variable amounts

- Follow your budget!

Comments

No Comments