Blown tire. Washing machine gives out. A freak accident turns into an emergency room visit. Any of these things could happen at any given moment, but do you feel financially capable of dealing with such instances?

An emergency fund is crucial to building and maintaining financial success, yet, many of us don’t have an emergency fund, let alone a small savings account. Today I’m sharing some ways to save $1,000--the start of an emergency fund, and help you on the way to financial success.

Not that long ago, I did not have an emergency savings account. I had hardly any savings to be honest. I was newly divorced, had moved to a new town, and during a period of about six months, all the money I did have was gone. It was pretty desolate at times. The irony of all of it was I was a financial advisor, so I knew what I needed to do to get myself on track, but had yet to take any steps.

As I came out of my post-divorce fog, I realized I was not going to continue to live paycheck-to-paycheck, and I started to take steps to remedy my situation. I did some things I had never done before (all legal, don’t worry) to get myself financially straightened out. I want to share a few ways to save $1,000 and start your emergency fund.

Why Start with Saving $1,000

You may be wondering why I recommend saving $1,000 versus another number—either more or less. There are a couple reasons.

The first reason I recommend saving $1,000 is it’s a good amount to start with if you’ve never saved before. When I first started my emergency fund, $1,000 seemed like so much money, and I had no idea how I was going to get to saving that much. When you use a larger amount, like three-months of expenses in savings, that can potentially overwhelm and actually keep someone even attempting to start saving in the first place. $1,000 in savings is a good starting point because it gives the saver a challenge if they’ve never saved before, but it also is a confidence-booster. If you can successfully save $1,000, you’re more likely to continue on your savings journey than quit.

The other reason I recommend saving $1,000 is because many emergencies that derail people financially are under $1,000. An appliance breaks down, or an unexpected car repair can really wreck havoc on your finances if you do not have a savings to dip into. That small cushion of a grand can do wonders for keeping your finances afloat and thriving.

Start Where You Are

When I was coaching my clients as an advisor, I always coached them to have three to six months of expenses saved for “just in case.” While it was hard to believe a “just in case” situation would ever happen, 2020 definitely proved to us the importance of an emergency fund as many were furloughed or laid off due to the pandemic. A study published in August 2020 by Bankrate found that only one in five Americans had enough emergency savings to cover three-to-five months of expenses.

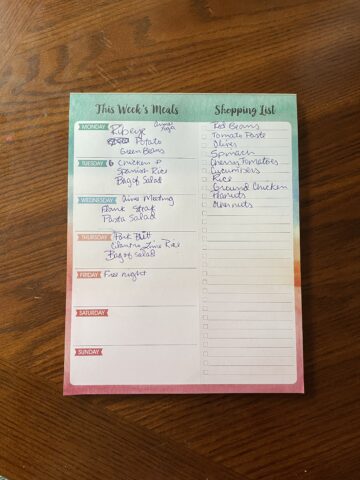

Instead of becoming overwhelmed at the thought of saving thousands of dollars, start by assessing where you are now. Take a look at your expenses, are there any expenses you can cut? Do you have any subscriptions that you pay for but don’t use? Are you ordering take out often, and can you replace that with home cooked meals? If you’re interested in learning about meal prep to stretch your budget, read some tips to get started here.

Pick an Amount and Automate

Have you ever heard the saying, “starting is the hardest part?” Of course you have, and of course you know it’s true. If you aren’t currently saving, what’s preventing you from doing so? If you know you will spend money if it’s in your account, can you automatically remove it from your account before you’re tempted to spend it? Even if your budget is extremely tight, can you set aside $5 each month or each paycheck to start saving? It may not seem like much, but baby steps are still steps.

After a couple months of not missing that $5 per paycheck, I want to challenge you--can you increase that to $10? Can you increase that to $20? Constantly evaluate how much you are saving, how it is affecting your budget and if you can stretch further and save more. You’d be surprised at how much you can put away.

When I started saving, I had to go to drastic measures to get out of my own way. I set up an account at a bank completely separate from my other accounts, and I set up an automatic deposit from each paycheck directly into that other account.

I also chose to bank with Aspiration Bank. It’s an online account--which really all banks are online now--and they are focused on investing in companies and causes that support reducing climate change and refuse to invest in companies that invest in fossil fuels. I also chose them because when I opened my account I received $25 from the company. Now, every time I refer someone (using this link) the person who opens the account receives $50 and I receive $50. It helps both of us grow our emergency savings.

Like I mentioned before, there is no shame in starting with $5 a paycheck or even $5 a month, and that’s where I started. I didn’t miss the money, my account started growing and it helped me build the saving habit.

Get Creative

If you’ve trimmed the fat from your budgeting by eliminating expenses, and you’ve automated your savings by setting up a separate bank account, you’ve already taken two huge steps to saving $1,000 for your emergency fund. However, you may want to jumpstart your savings and you’re looking for more ways to get more money set aside.

Here’s a few creative and different ways I helped grow my emergency savings when I first started:

- Got a part time job: If you want to ramp up savings quickly, sacrificing your free time temporarily might be the way to get the savings engines revving. I added 10 hours a week to a part time job over the summer to help me increase my cash flow.

- Sold my Stuff: I am a hoarder and I know it. I am working through my junk (literally) and nothing lights a fire under you like looking at all the stuff you have you don’t use and the low number in your savings account. I sold on Facebook Marketplace, took clothes to consignment shops, and even hosted a couple garage sales to recoup some cash.

- Did Online Surveys This is not a huge money maker, but as you’re trying to start saving and looking for extra ways to put money aside, this one is super easy, and you can do it anywhere. I normally take surveys while I’m waiting in line, or in a waiting room or waiting for a train to pass through town, and I earn about 50 cents per survey–like I said, not a lot–however, about every six months, I get an extra $30 that goes into my paypal that I then transfer to my savings. I use the service Inbox Dollars, and again, here’s a link to sign up.

Saving $1,000 for an emergency fund can be intimidating if you’ve never saved before, but it can be done. What are things you have done to save money? I’d love to hear!

Looking for more tips on improving your financial situation? Check out these posts:

Comments

No Comments