Paying down debt is crucial to financial security and building wealth. Today, many people are plagued with debt and are unsure of how to get started lowering their debt. I’m sharing a step-by-step guide of how to quickly pay down debt and improve your financial situation.

About two years ago, I finally decided I needed to make a financial change in my life. I was living on an average of $1,300 a month, not saving anything (emergency or otherwise), and my credit card debt was growing because I was only ever paying off the minimum balance. I knew I did not want to live the rest of my life in such a way that I could not get ahead.

A year ago, I found myself in a job that was providing me a steady stream of income that allowed me to bring home about $1,900 a month, and gave me the ability to be more aggressive with paying down debt. While it still was not a large chunk of income, it gave me the push to get moving on my debt.

Here are the steps I took over the last year that helped me pay off almost $5,000 in the last eight months while also saving into my emergency fund and living comfortably.

Upgrade Your Mindset

When attempting to pay down debt quickly, you have to be in the right frame of mind so your actions that follow are fruitful. When I started down my debt consolidation journey, I shifted my mindset from, “this is a lot of debt, how in the world do I even start?” to “the amount of debt I have is what it is; I am going to start attacking this one day at a time.”

I shifted my mindset from despair to belief. I believed in myself and knew I had it in me to take on this mountain of liability.

I also shifted my spending mindset. I knew if I wanted to accomplish my goal of paying off my debt, I was going to have to shift my lifestyle temporarily. I knew this lifestyle and spending shift would not be long-term but I also knew debt pay-off would not happen without a change.

Refuse to Add More Debt

Once I fully committed myself to quickly paying down debt, I stopped adding more debt to my plate. I stopped using my credit cards, deleted them from my online accounts that store card info for easy checkout, and moved my credit cards out of my wallet and stored them where I wouldn’t be tempted to use them.

Without having easy access to my credit cards, I stopped thinking of them as an option for purchases. If there wasn’t money in my bank account, my cards were not a fallback for purchases I didn’t need to make.

Lower Monthly Expenses to Put More Money Towards Debt Payments

There was not a lot of wiggle room in my budget when I started paying down debt. Expenses were taking up much of my monthly take home, so I had to reevaluate where my money was going.

- I tracked every dollar I spent for two months, and figured out where my money was going, and if there were any purchases I could cut. Here’s what I cut:

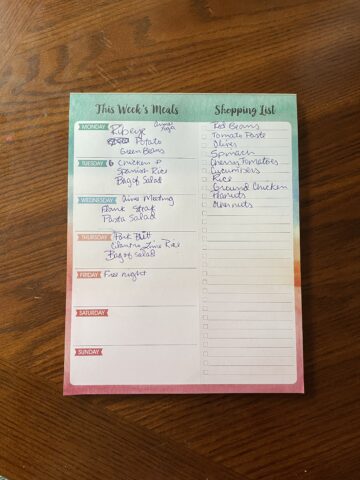

- Stopped eating out, planned my grocery purchases and figured out how to save on groceries (read How I Save Money on Groceries here). I was spending about $150 a month on take out, delivery and happy hours. That’s a great debt payment right there!

- Started making coffee at home instead of running through the drive through each morning (Looking to start making coffee at home? Check out my favorite budget-friendly coffee gadgets here).

- Cut my utilities bills. I asked my neighbor if I could pay them to share their internet. Instead of paying $60 a month on my own for wifi, I paid $30 a month and shared. My internet was slightly slower, but I knew this was temporary and that extra $30 could go a long way to quickly pay down my debt. I also only ran my air conditioner when the temperature outside got above 90 degrees. Was it uncomfortable? A little, but I also knew this was not a permanent way of living. My electricity bill was under $40 a month compared to nearly $100.

Increase Your Income Streams

I really wanted to get aggressive with paying down my debt, so I got a part time job for a while. On top of my full-time job, I worked an extra 10 hours a week and made about $150 per week. This gave me an extra $600 a month. I took this extra income and split it between debt pay off and emergency savings. I only worked a part time job for three months, but in that three months, I was able to take a good chunk of debt off my plate AND contribute to my emergency savings.

Along with a part time job, I also worked on building my passive income streams. What is passive income? It is income that you earn without actively working, or working once, and continually making money off that work. One of my passive income streams is this blog where I use affiliate links to receive a small commission when people click and use those links.

My other passive income stream is my Etsy Shop, AB Designs & Writing. I have some graphic design experience and have designed printables that people purchase and print at home. Each design took me about half an hour to create, and now I make money each time someone purchases from that shop. I have made about 20 sales from this shop, which isn’t a ton, but I am confident it will continue to grow!

Make Extra Payments on Credit Cards

Outside of my extra income I brought in and cutting my expenses, I also started to make smaller payments on my credit cards that matched my biweekly paycheck from my full time job. While this small trick may not seem like much, it actually helped me pay more, decrease the interest the credit card company was charging me, AND benefitted my credit score.

If you can’t pay the minimum payment on a card all at once, try this trick. Chunk those payments out. Or, if you can plan to pay a certain amount every week or every other week, no matter what your minimum payment is, you’ll end up paying more towards that balance than if you were to just pay the minimum payment once a month.

Conclusion

While I still have a long way to go in my debt pay-off plan, these five tips have helped me pay off nearly $5,000 in eight months. I’m excited to look back in eight more months and see what my debt balance has shrunk to.

What are some ways you’ve paid down debt?

Looking for more ways to save money and build your wealth? Check out these posts:

How To Save Money for the Holiday Season

How to Save Money on Groceries

Comments

No Comments